“Now that you’re earning, you should do some kind of financial planning!”

“Don’t splurge your entire salary over one weekend”

“Do you really need another pair of shoes?”

If you’re a 20-something year old Indian who’s just embarked on the glorious journey of financial freedom — you’ve

definitely been thrown at least one of the above lines, or something roughly the same.

Don’t worry, this isn’t another blog where we talk about how important it is to set aside savings for emergencies, or

how doing a bit of financial planning for your retirement early on is a good idea.

Because that, you already know.

So we’re going for the why and how in this blog — because that’s actually the road block, isn’t it?

The Why

For most Indians, finance and financial freedom are rarely touched upon subjects. Our schoolwork does not include the

concepts of expense and investments, and at home money management as a habit is inculcated far too late, or never at

all.

Fortunately the past couple of years have seen a change in this, and more and more young millennials are taking an

active interest in their own finances.

Yet, investment is an avenue that most of us still avoid, or delay due to certain hesitations and presumptions we hold

from the lack of better financial insight.

So everything’s A-Okay in the “I know I should start investing” department — then what is it that’s holding back most

young Indians from just getting started already?

If there was ever a catchphrase that could summarize the plight of all young adults, it would be this one.

And understandably so.

It’s a constant tug-of-war between making the responsible choice and living life one day at a time.

Sure there’s saving to be done and investments to be made but — there’s also rent to be paid, taxis to be taken,

scooters to be refueled, subscriptions to be renewed — and then, a little bit of splurging, because you do live only

once.

But the truth is that Carpe Diem applies to investment journeys as well — because every day that we’re not seizing to

invest, is a little less money being generated for the long run.

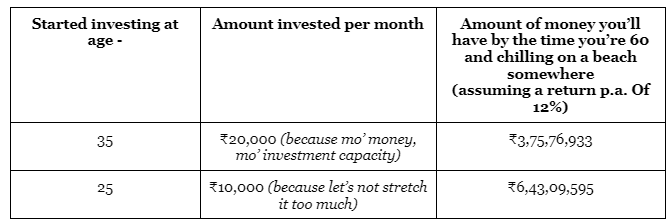

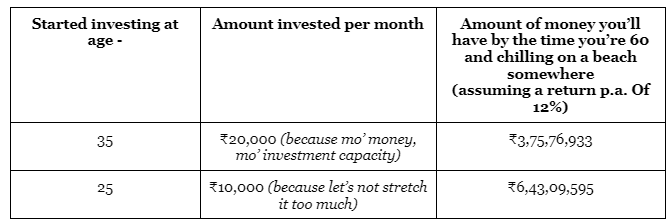

Monthly investment vs wealth metric based on what age you start investing at

Monthly investment vs wealth metric based on what age you start investing at

“Now that you’re earning, you should do some kind of financial planning!”

“Don’t splurge your entire salary over one weekend”

“Do you really need another pair of shoes?”

If you’re a 20-something year old Indian who’s just embarked on the glorious journey of financial freedom —

you’ve

definitely been thrown at least one of the above lines, or something roughly the same.

Don’t worry, this isn’t another blog where we talk about how important it is to set aside savings for

emergencies, or

how doing a bit of financial planning for your retirement early on is a good idea.

Because that, you already know.

So we’re going for the why and how in this blog — because that’s actually the road block, isn’t it?

The Why

For most Indians, finance and financial freedom are rarely touched upon subjects. Our schoolwork does not

include the

concepts of expense and investments, and at home money management as a habit is inculcated far too late, or

never at

all.

Fortunately the past couple of years have seen a change in this, and more and more young millennials are

taking an

active interest in their own finances.

Yet, investment is an avenue that most of us still avoid, or delay due to certain hesitations and

presumptions we hold

from the lack of better financial insight.

So everything’s A-Okay in the “I know I should start investing” department — then what is it that’s holding

back most

young Indians from just getting started already?

If there was ever a catchphrase that could summarize the plight of all young adults, it would be this

one.

And understandably so.

It’s a constant tug-of-war between making the responsible choice and living life one day at a time.

Sure there’s saving to be done and investments to be made but — there’s also rent to be paid, taxis to be

taken,

scooters to be refueled, subscriptions to be renewed — and then, a little bit of splurging, because you do

live only

once.

But the truth is that Carpe Diem applies to investment journeys as well — because every day that we’re not

seizing to

invest, is a little less money being generated for the long run.

Monthly investment vs wealth metric

based on what age you start investing at

Monthly investment vs wealth metric

based on what age you start investing at